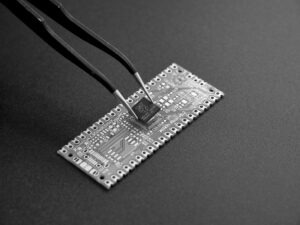

Despite slowdowns in the semiconductor industry and mass layoffs continuing across the tech industry at large in Q1 2023, there remains a shortage for niche tech talent across semiconductor, renewables and battery and embedded systems industries. Here, we speak to our team about the impact on the hiring market in these industries and their predictions for the year going forward.

Semiconductor Industry Trends

Semiconductor talent was in short supply in 2022, and the shortage is expected to worsen this year, despite the industry experiencing its steepest slowdown in over a decade. The WallStreet Journal estimates that the average monthly shortfall in semiconductor workers is around 27,000, a 44% increase from 2022. Others estimate that up to 90,000 workers need to be added by 2025 to meet the most critical workforce needs.

The race to localise semiconductor manufacturing in the US and across Europe, backed by government incentive schemes upward of $100 billion, aimed to shift reliance away from Asia, where 80% of the industry’s manufacturing is currently based, is driving the skills shortage.

Future of Semiconductor Industry

It’s estimated that the semiconductor workforce, which currently sits at over 2 million direct employees, will need to grow by another million by 2023.

Intel aired Sunday night football ads to lure in new technical talent and recently announced $2.4 billion in cash and stock incentives to retain staff, despite a 39% YOY drop in adjusted revenues.

Chris Canneaux, manager at European Recruitment, says that while the market is slower than last year, some skill sets are still massively in demand. He sees an abundance of junior candidates on the market who want to get their foot in the door, while senior candidates with the hand-on experience needed right now are still in short supply.

Renewable Energy Industry Trends & Battery Industry

Karen Robinson, Principal Consultant at European Recruitment, has seen first hand a similar talent shortage in the renewables and battery industry in the US, with more start-up companies in the energy storage space coming into the market looking for specific battery talent. According to Mckinsey, global demand for batteries will continue to soar globally over the next decade, with growth expected to be highest globally in the EU and United states, driven by recent regulatory changes. It is estimated that at least 120 new battery factories will need to be built between now and 2030 globally.

There still isn’t enough talent to fill the positions, she says. “They’re screaming out to hire people.” Smaller companies are getting creative in order to fill the talent gap, bringing people into the business from the automotive and chemical industries and helping them learn the skills on the job. More established companies, she has found, need people who can “hit the ground running,” and can command the salaries, benefits and bonuses to secure the talent they need.

Entry level positions in renewables can start on six figures and go up to as much as $160,000 with just a few years of experience in the US, she notes.

Embedded Software

The global embedded systems market is expected to reach $126.7 billion by 2028, being a key technology driver in the restructuring of the automotive industry with use in hybrid and electric vehicles, as well as for smart gadgets. Doron Mazor, Team Lead at European Recruitment, has seen some American companies coming into Europe and paying American salaries and the opportunity for remote work to entice local talent. “When they’re paying American salaries in Europe, they’re going to win the battle for candidates,” he says.

Yet overall, he sees both embedded candidates and clients being more selective in the process compared to last year.

“We’re over the bubble of companies being so desperate to take the first people they interview, and they’re becoming more specific with what they want,” he says. Companies are also adjusting their strategy to retain their staff. “They’re making more conscious efforts to retain the teams they have, rather than being reactive,” he says.

Candidates too, are taking the time to understand if the company is right for them, rather than being won over by attractive compensation, he says. Stability is a driver for many candidates coming onto the market. Establishing a relationship with a recruiter they trust is key. “We focus on whether the role is the right fit for the candidate, we don’t bully people over a line,” he says.

It’s crucial for candidates and clients alike to partner with the right recruitment partner who understands the unique challenges faced in current market conditions as well as who have the in-depth understanding of hiring needs going forward. If you need help finding your next tech hire or would like to have a discussion on current hiring market trends, please get in touch at marketing@eu-recruit.com.

If you are looking for your next career opportunity please take a look at our LinkedIn job advertisements or register your interest here and we will be in touch.